It’s our 1-year anniversary!

We sent out our first Investor Day email on August 18th, 2020 to 75 investors. Since then we’ve shared over 500 actively fundraising startups with a network of investors that has grown 10x.

Thank you for being a part of it and if you’re up for it we would love to hear how you think we’re doing:

And of course - if you click below you’ll find an impressive group of 13 startups actively raising $17.5M!

Did you get this forwarded to you? Do you want to receive these directly to your inbox every other week? It’s free and it works.

Continue on to check out some awesome fundraising stats from our OnePager users, top picks from Peter Conley, and a look at all the product improvements we launched in the last two weeks.

OnePager Fundraising Data

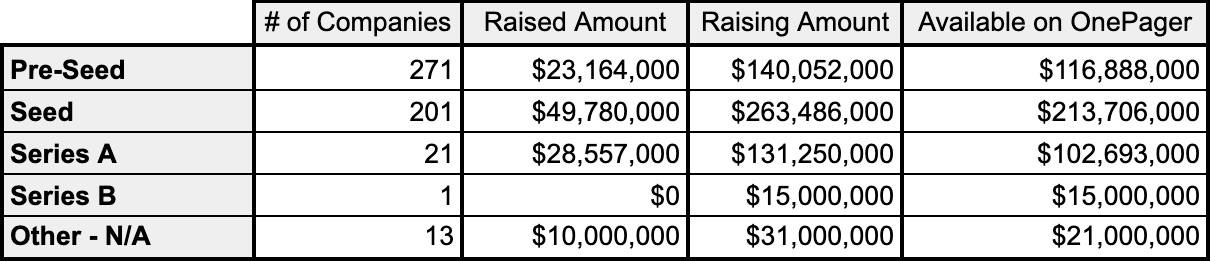

A quick guide:

Raised amount or Money Raised - The amount a company has inputted into their OnePager as having already been raised. The amount they already have.

Raising amount or Money Being Raised - The target total amount a company has inputted into their OnePager that they’re hoping to raise. The total they’re going after.

Available on OnePager or Available Investment - The difference between the Raised amount and Raising amount. The amount that’s still being sought by companies.

We check in on these numbers periodically and it’s always amazing to see the volume of opportunities. These are user inputted numbers and haven’t been verified, but we look to them to get a high level view of the companies raising OnePager.

Here are some of our key takeaways:

Very Pre-Seed and Seed focused - We see a clear skew to earlier rounds with Pre-Seed accounting for more than 50% of fundraising OnePagers and Seed taking up the vast majority of the other half.

SAFEs - Pre-Seed rounds heavily favor SAFE terms and Seed rounds are similar, but not as decisively with ~25% opting for a Priced round and another ~25% choosing to use a Convertible Note.

~20% committed - The average OnePager user has already raised about 20% of their round. The deviation on this average is reasonably wide, but generally points to founders using OnePager who have already brought in some capital.

+$300M - There is over $300M of available space in active Pre-Seed and Seed rounds from teams that are using OnePager today!

Guest signal from Peter Conley, Burch Creative Capital

Peter is an investor at Burch Creative Capital where he’s a part of the team that’s bet on companies like Blink Health, Outdoor Voices, and Rappi. Before Burch, Peter received his undergraduate degree from Georgetown and went on to receive a Masters from the Fuqua School of Business at Duke. You can find Peter in New York City.

Want to connect with Peter? Shoot him a connection request on Linkedin.

Peter’s Top Picks:

Agricycle Global - Democratizing access to the agricultural value chain.

Despite an increase in sustainability efforts over the past decade, food has been left behind with overproduction resulting in the loss of perfectly good food, particularly within Africa. Agricycle's solar dehydrator supply and consolidation of existing supply chains helps recycle and export otherwise wasted food to other countries. This sustainable food startup presents solutions to two preeminent problems: food waste and declining food resources.

CHNL - Connect with others without being the product.

Data monitoring has become a central concern for many social media users. CHNL's platform provides full control and transparency as to how data is being shared and used. With 14,000 on the waitlist, CHNL is positioned to capitalize on a hot-button issue in a growing market.

Rationarium - Content Democratized

Rationarium is using their experience in open access education to protect content authors while providing high-quality, low-cost materials to students. Their system provides improved financial support for educational content authors, teachers, and students. Rationarium also reorganizes how open access information is displayed and accounted for. These tweaks to an archaic system could put them in position to lead an industry that has barely reached infancy and has massive potential.

The last two weeks at OnePager

In the last newsletter we were excited to announce Jack O’Brien joining us full-time as CTO! It’s only fitting for us to follow that up with some of the improvements we’ve been able to push out since then:

Drag & Drop Reordering - Founders can now easily reorder their team members, FAQs, and Investors. This has been a long time coming and we’re excited to make this easier for users. The next big step is to be able to reorder the cards themselves (similar to reordering blocks in Notion).

Visitor Analytics Export - Users can now export their visitor analytics data as a CSV to organize in other tools as they see fit. OnePager is a great top-of-funnel tool and to be able to easily pull that data out to bring into other systems is something users are excited about. It also typically costs $60/mo to get that functionality from Docsend and we like being able to do the same for $14/mo.

Easy Follow-ups from Analytics - Now, when a user sees a visitor’s engagement in their analytics dashboard they can easily follow up via email from that same page. This makes it easy to check-in quickly and keep leads warm. Any responses are then diverted to your inbox so the conversation can progress from there.

Stage and Size Tags - Users can now input the size of their team and their stage (pre-revenue, post-revenue, etc.) in the Company Card. This allows founders to enrich the information visitors see when they first get to their OnePager and communicate more of who they are faster.

Builder Refresh - We updated the way founders input information into the Builder (where they fill in data for the published OnePager) to be cleaner and more intuitive. Things like smoother transitions and clearer character limits.

Links in Decks - We had a couple requests this week from founders who had links in their pitch decks that weren’t clickable when viewed within OnePager - we fixed that. Now links in pitch decks are clickable and open a new window so you can easily check out the links you see listed.

ShortStack (beta) - We released a feature to a small group of users that allows them to easily share a link-in-bio version of their OnePager. This pulls out all the available links in a OnePager (website, demo, linkedin, etc.) and creates an experience similar to Linktree with a link to their full OnePager listed first. We’re still testing it out, but we’re excited to hear how our users react to the extra functionality.

More to come soon!

Thank you!

Thanks for getting this far and please never hesitate to reach out to companies directly if you’re interested in learning more about what they’re building. If you’re reaching out to a lot of companies and want some help doing it in a more efficient way please reach out and we can help.

Feel free to share this email with other investors as you see fit - we only ask that you don’t distribute to any large groups without our approval. As always, any product feedback or questions about what we’re building at OnePager are welcome!

Talk soon,

Adam, Nic, Jack

PS - Respond here or email adam@openscout.vc to see the +500 companies featured in previous OnePager Investor Days.